This package focuses on the energy markets. Stable long and short seasonalities in Gasoline (RB), Crude Oil (CL) and Natural Gas (NG) are traded here. The strategies in NG and CL can be scaled down, unfortunately RB cannot. RB is also an expensive future and can only be traded with an appropriate account. There is very high volatility in the energy markets at the moment. This provides very high potential, but also more risk and volatility for the portfolio.

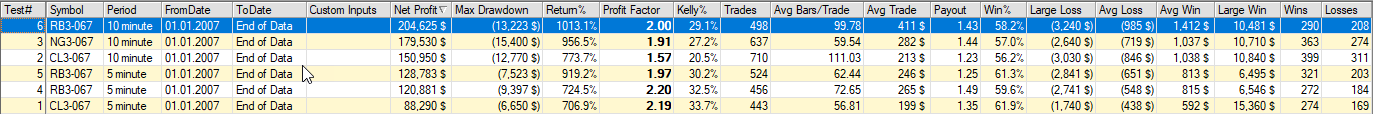

The table below shows the results of the basket with the 6 strategies back to 1/1/2007 (as of 12/16/2022).

The holding period of the trades is several hours (see Avg Bars/Trade in the table). The strategies were built in the 5 or 10 minute chart. An RB and CL trade on the same day and correlate accordingly. I wanted to show an alternative here.

In the videos I show my approach to strategy development and how I trade the strategies. In 3 additional videos I show what seasonalities are, how I can track them down and convert them into strategies.

My strategies are always very simple. I don't want to trade anything complicated and stay as close to the basic effect as possible. From experience I know how far I can go in programming. In general, the following applies: "The more indicators and unknowns you build into the strategy, the more unstable the strategy will become! Keyword: Overfitting!"

Price: 1462,5€

I also offer 1 Skype session to answer any questions about the strategies.